The Realtors Association Throws Its Weight Around

By Rob Schofield

One of the great myths of modern American politics and policymaking concerns the role and nature of “special interest groups.” Too often, the term has come to be associated with those who advocate for causes like the rights of minorities or children or the disabled and other traditionally vulnerable and/or disenfranchised sets of people. Indeed, to hear some people describe things, policymakers are constantly besieged by an army of do-gooder groups who would bankrupt the state (and taxpayers) in pursuit of narrow and meddlesome objectives.

Meanwhile, according to this myth, noble and innocent business interests who seek nothing other than the freedom to ply their trades and reap modest profits must fight constantly to ward off the intrusive and confiscatory efforts of wild eyed legislators bent on redistributing their hard earned wealth.

The Real Special Interest Groups

The reality of the situation is actually quite different. In North Carolina, the most powerful special interest groups are not the nonprofit advocates for progressive (or even conservative) causes. For the most part, these groups act like (and are, in fact) “public” interest groups – that is, they do what they do not to enrich themselves, but out of a commitment to a mission and an understanding of the common good.

Real special interest groups are easily distinguishable from public interest groups. While they may often portray their advocacy as benefiting the public at-large (and sometimes the two can overlap), real special interest groups are not motivated by a vision of the common good, but rather by a drive to make more money – for itself, its owners, and/or its members or constituents.

Especially in recent years, many of these groups have learned through experience to treat government policymaking just as they would treat any number of hurdles in the dog-eat-dog marketplace in which they normally operate, i.e., part of the cost of doing business. The reasoning is simple and straightforward: Invest more in campaign contributions and a sophisticated lobbying effort and maximize one’s income. A $100,000 or $200,000 investment in public policy advocacy can easily lead to a multi-million dollar return in a differently regulated marketplace.

To get a feel for who the real special interest groups are in North Carolina, one need only look at the list of lobbyists and “principals” (i.e., the groups the lobbyists represent) on the website of the Secretary of State. As becomes readily apparent upon examining this list, the vast majority of interest groups lobbying North Carolina policymakers are for-profit businesses and associations. This is not to imply that there’s anything illegal or immoral about this fact. Everyone has a constitutional right to petition the government. The list does, however, provide both a reminder about who really has the ear of state officials and a grain of salt to accompany some of the public relations campaigns that have been launched by various special interest groups that purport to be about advancing the common good.

Special Interest Group Poster Child – The N.C. Association of Realtors

In North Carolina, there is no better example of a powerful, active and skillful special interest group than the N.C. Association of Realtors. Three years ago, the group was part of an extremely successful public policy campaign to alter the public school calendar in order to increase tourism (and vacation rental property) revenue. By skillfully aligning itself with tourism interests and a band of disaffected public school parents flying the “mom and apple pie” banner “Save our Summers,” and ultimately, cutting a deal to win teacher support via what amounted to a back-door pay increase, the group overcame the united opposition of education experts and administrators of widely varying stripes (though a move is now underway to reverse the change). In further confirmation of the hardball nature of the 2004 effort, the chief legislative sponsor of the bill resigned her seat shortly after the bill’s passage to accept a lobbying position with the tourism industry.

In 2007, the Association of Realtors has launched a new public policy campaign that features a mom and apple pie tone. This one is in opposition to the growing drumbeat to raise the state real estate transfer tax (a small excise tax on realty transactions known as the Deed Stamp Tax) or to give local officials new power to raise the tax locally. As reported in the April 2 edition of the NC Policy Watch Weekly Briefing, transfer taxes are popular throughout most of the country and could provide significant new revenue with which state and local governments might confront explosive growth and ravenous demand for new public services and investments. Moreover, North Carolina’s current tax rate is extremely low. Many states use the transfer tax as a source of revenue for the construction of affordable housing and the preservation of open space.

According to the Association of Realtors, however, the transfer tax is a “home tax” on the “American Dream” that will adversely impact home sellers. Realtor profits are never mentioned. In coordination with a special “527 group” known as the NC Homeowners Alliance, the Realtors have sought to mimic the pattern of the Save our Summers campaign from 2004. Their slickly produced TV and radio ads feature a simplistic message about hardworking people besieged by an intrusive government bent on extracting all of the equity out of their homes.

Setting the Record Straight

The Realtors’ anti-transfer tax campaign is an example of an increasingly common phenomenon that has come to be known as “Astroturf advocacy.” This term was coined to describe what amount to phony or manufactured grassroots campaigns in which business interests attempt to convince policymakers that there is a public groundswell on an issue that impacts their bottom line. Hence the effort in the Realtors’ ads to create the impression that homeowner equity is what’s really at stake in the transfer tax debate, rather than realtor profits or a small bump in home prices.

While the Realtors Association professes to be sincere about its concern for North Carolina’s homeowners (many of whom, at least in boom counties, are selling their houses for two and three times what they paid for them), there can be no doubt that the real motivation for the group’s efforts surrounding the transfer tax debate is (surprise!) to protect realtor income. The Association claims would ring truer if the group or its national affiliate gave any indication of a real and meaningful commitment to a policy agenda that benefits the broader public interest. A search of the record, however, provides scant evidence of any such commitment.

Indeed, despite their enormous power, size and visibility (and, some might add, responsibility), neither the National Association of Realtors nor the North Carolina group appears to be actively advocating in support of public policies on any major issues of the day that aren’t directly related to their industry and its economic well-being. If the Realtors Association were truly concerned about North Carolina’s middle class homeowners, for instance, one might expect its leaders to actively speak out in favor of adequate funding for public education or comprehensive reform of the state’s regressive tax system – something that never happens. Ironically, the National Association’s website acknowledges a need for reform of the health care system, but only because one in four realtors are uninsured, not out of any sense of responsibility to society as a whole. Universal coverage is not a part of their proposed solution either.

In short, the Association of Realtors is the quintessential “special interest group” – a large and powerful, for-profit entity that seeks all of the benefits that come with participation in the modern public policy making system and offers little or nothing in the way of sacrifice or commitment to the common good. The success or failure of the anti-transfer tax campaign could serve as a bellwether for the plans of likeminded special interests in the years to come. North Carolinians should pay close attention.

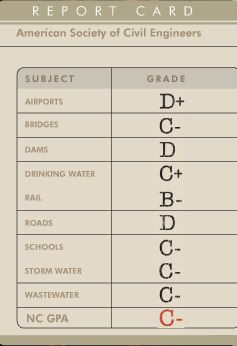

The North Carolina League Of Municipalities reviews why we cannot afford to let our infrastructure crumble:

The North Carolina League Of Municipalities reviews why we cannot afford to let our infrastructure crumble: