It’s Time We Get Serious…about OUR TAXES…and OUR VOTES!

Guest Post by Mike Cross, Chatham County Commissioner:

It will soon be time for us to vote “For” or “Against” the 0.4% Land Transfer Tax and I want you to understand what we will be voting for or against, BEFORE you cast your vote! The National Planners Association has identified 10 Mega Regions in the US where massive growth is expected to occur. Of the10 Mega Regions, Chatham County will be part of the Number 1 high growth region (Triangle, Triad into Charlotte-Mecklenburg ). The NCDOT has already designated US64 as a future “Super Connect” between Raleigh and Charlotte. The Association of County Commissioners and the Triangle J-Council of Governments (Orange, Wake, Johnston, Lee, Moore and Chatham) agree that massive growth is coming.

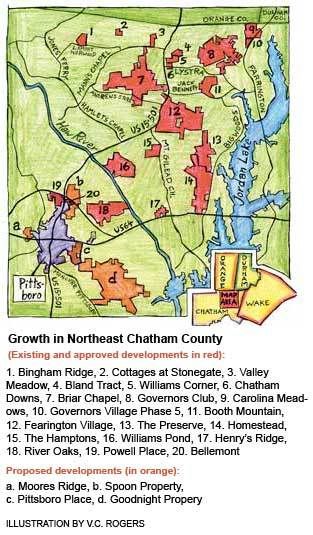

Wake, Durham, Orange, Johnston, Harnett, Lee and Moore are growing “gang busters”. Maybe there’s something to these projections! Whether this turns out to be true or how long it will take to occur are questions I can’t answer. We certainly do have all indications that growth is coming to Chatham with approximately 15,000 homes approved for construction and more proposals coming every week.. With growth, comes requirements for schools, services, other public facilities and the infrastructure to support these requirements.

Based on a .4 students average per household, we may be looking at up to 6 thousand new students over the next 10-12 years. That equates to 6 to 8 new schools; approximately 1 new school every 2 years, plus an average of $1Million in operating cost, per year, per school!

Many have been very outspoken about growth “pays for itself”. Well, it doesn’t pay upfront and it certainly doesn’t appear to have paid it’s way in Wake, Raleigh or Cary, at all – roof tops, commercial, retail, hi and low tech industry - what else does it take to make it “pay for itself”? Last November,’06, Wake County voters approved $1.056 BILLION for Capital Improvements with $970 MILLION going to school construction. This month, October, they approved $276 MILLION in additional Bonds. All this debt will go on their property taxes…increases! Is this the example of how “growth pays for itself”? This is Halloween “Scary” to me!

With an average cost of $375,000 on new homes, these new homes are obviously not being built for current Chatham residents. Our new citizens are going to expect their schools and services to be in place when they arrive. Waiting until their first property tax payments come in to start planning and construction, simply isn’t going to work. Maybe a little up-front revenue generated by our newcomers would be appropriate.

No one wants higher Property Taxes or higher School Impact Fees! In fact, I don’t know anyone who wants higher taxes, period and no tax appears completely fair to everyone. But the requirements of growth have to be paid for and here is the opportunity for us to decide just how we prefer to pay for at least some of it.

There will have to be significant tax increases in our future, so we are really voting on which tax we prefer to start with. Our BOC is requesting your support with the 0.4% Land Transfer Tax , because we believe this is the most fair option. It’s based on sales price, whereas SIF is a flat fee regardless of sales price or square footage. Seems more fair to me. Without the LTT, we will have to, once again , go to Property Taxes, School Impact Fees and/or take another look at imposing Adequate Public Facility Fees.

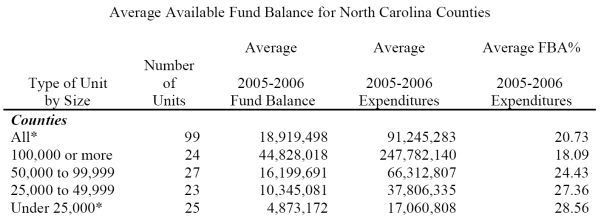

The 0.4% LTT is not a “Do All/Fix All” tax, but it would allow us another option to pay Debt Service on at least one new school. It takes $1 Million/year for debt service for every $10 Million borrowed and schools are very expensive: Elementary,$18-$22 Million - Middle, $24-$28 Million – High School $38-$43 Million!

The 0.4% LTT would be negotiated in the transfer/sale/purchase of property. It does not apply to wills or gifts and it does not arrive in the mail every year. For most of us, that means we don’t need to be concerned, unless we decide to sell or buy. It’s a relatively small tax, only1/15th as much as the normal Realtor’s Fee.

You have no doubt read or heard some of the following quotes from those who oppose LTT:

- “Growth has and will pay for itself”…and the LTT “will only encourage wasteful and inefficient spending.” Growth hasn’t paid for itself here and the Chatham County budget process is used by the UNC School of Government as the example of how the budget process should work…wasteful, inefficient, I don’t think so!

- “Pending Home Sales Fall to Record Low”, “New Home Sales at Seven Year Low”,

Foreclosure Rates Hit Record High”, “Mortgage Mess is Big, Murky”. Not in Chatham!

I believe the “whatever it takes attitude” of some folks in this industry ; i.e. “creative financing” arrangements and “qualifying” unqualified buyers (those citizens whom they know can’t afford what they are selling) is largely responsible for these problems and they must know these deals are risky…and yes, they do reap their profits and only the mislead buyer and his or her families are devastated.

“Who’s paying for the Anti- LTT effort?” The North Carolina Realtors Association is the primary contributor. They have blocked all LTT efforts since 1990 – millions in political contributions, TV/Radio ads, Mailers, Telephone Call Banks, Emails and Paid Lobbyist to put the heat on us and our Legislators. Why do they do this? 6 NC Counties and 38 of our 50 States have LTT. It has proven to be beneficial to this industry and the citizen communities where it is applied. Schools, Services, Public Facilities and Infrastructure help to “SELL” their products! Thankfully, many of our Chatham Developers, Builders and Realtor realize these benefits and actually support our LTT Referendum.

“Politicians Should Listen to the Voters”. I certainly agree!…and apparently, so do the majority of our NC Legislators. Perhaps now would be a good time for Voters to listen to their elected officials; the citizens to whom they have bestowed their “Public Trust”.

I have now served on 2, very different, Boards of Commissioners and 8 consecutive County Commissioners have agreed on our Capital Improvements Plan and all agreed to seek LTT to help pay the bills.

Most of us are really tired of higher property taxes. Many simply cannot afford more. For some, it’s already a matter of food, medicine or heat for the winter. And remember, if I vote to raise Your property taxes, I would also be voting to raise My property taxes and I really don’t care to do that! LTT would soften that action.

Property values in Chatham have increased tremendously and large profits are being enjoyed. Those who are profiting – Investors, Developers, Builders, Mortgage Bankers, Attorneys, Sellers and Realtors shouldn’t expect the current/average Chatham citizen to foot all of the bills for the new schools, services, facilities and infrastructure required to support and sell their future products.

Without massive and rapid growth, we probably don’t need anything! But since it is quite apparent that this influx of growth is coming, whether you or I like it or not, help your BOC pay the bills.

Please VOTE “FOR” the 0.4% Land Transfer Tax.

I thank you for your support,

Mike

Editor's note: this is a personal opinion article

Update: Senate Votes To Help Strapped Homeowners. Legislation expands the role of the Federal Housing Administration in making federally insured loans more widely available. Like a scene from "It's A Wonderful Life" legislators have rallied to save the mortgage bankers and their customers just in time for the holidays.

Update: Senate Votes To Help Strapped Homeowners. Legislation expands the role of the Federal Housing Administration in making federally insured loans more widely available. Like a scene from "It's A Wonderful Life" legislators have rallied to save the mortgage bankers and their customers just in time for the holidays.

Ever wonder about rising construction costs and why it's so absurd to expect spending on infrastructure to stay within the limits of consumer inflation (CPI) while keeping up with growth?

Ever wonder about rising construction costs and why it's so absurd to expect spending on infrastructure to stay within the limits of consumer inflation (CPI) while keeping up with growth?

This came in my email last night:

This came in my email last night:

The North Carolina real estate industry has a little secret that may get a little sunshine, or

The North Carolina real estate industry has a little secret that may get a little sunshine, or

Chatham County has been a political laboratory for developers and realtors in recent years, as documented by Jennifer Strom in The Independent:

Chatham County has been a political laboratory for developers and realtors in recent years, as documented by Jennifer Strom in The Independent:

NC Realtors' spokesperson "Angie" is not quite the red pickup driving happy homemaker she seems. She has been seen

NC Realtors' spokesperson "Angie" is not quite the red pickup driving happy homemaker she seems. She has been seen  When Angie began this campaign she was a homeowner but far from an average homeowner. Her name was on the deed of a west Raleigh home with a market value of about $500,000, about twice the median sales price of NC homes. On this particular street homes are listed on the MLS for about twice the current tax value, often as "tear-downs" and new infill homes sell in the order of $1,000,000. By the time the legislative session had ended (with a transfer tax option in the State Budget) Angie was no longer a homeowner and hardly happy. She had a modest rental apartment near Raleigh's Five Points having signed over her share of the deed to the husband from whom she separated.

When Angie began this campaign she was a homeowner but far from an average homeowner. Her name was on the deed of a west Raleigh home with a market value of about $500,000, about twice the median sales price of NC homes. On this particular street homes are listed on the MLS for about twice the current tax value, often as "tear-downs" and new infill homes sell in the order of $1,000,000. By the time the legislative session had ended (with a transfer tax option in the State Budget) Angie was no longer a homeowner and hardly happy. She had a modest rental apartment near Raleigh's Five Points having signed over her share of the deed to the husband from whom she separated.