Ashe County Can Decide Without "Help"

Thank you so much, but...

Editorial from The Jefferson Post in Ashe County, published: Monday, April 21, 2008 12:16 PM CDT

We appreciate all this interest, but it is our position that the citizens of Ashe County are quite capable of deciding how they wish to be taxed without all this outside help. One wonders where these groups were back in the fall of 2001, when our county was shattered by plant closings and West Jefferson’s downtown had far too many “for rent” signs in storefronts.

:::::

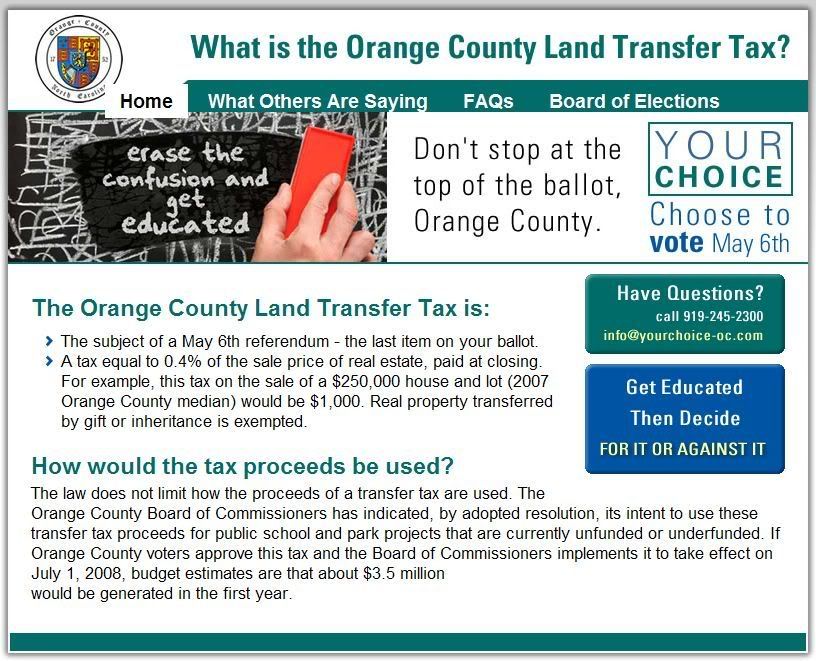

The transfer tax issue is fairly simple. We face some financial challenges in this county, specifically paying for two major capital projects, the new law enforcement center and the library expansion. Both are important and necessary - though we believe the services offered by the improved library will, in the future, reduce the need for a jail here. At the same time, county government is facing the same staggering cost of gas and fuel oil we are all facing. That is the reality.

We, as citizens of the county, must pay these bills. The question is how - by increasing the ad valorem (property) tax or having a transfer tax for non-family land sales. We do not believe this is all such a mystery that our citizens are not capable of deciding how we, as a county, shall pay our bills.

We hope our new-found friends in Raleigh will not forget us after May 6, as we struggle to deal with the serious layoffs and transfers now taking place at Leviton. We trust they will have the same interest, as we struggle to face this and many other challenges here in the “Lost Province.”