Say Yes To Transfer Tax

It's not rocket science

Support Your County Transfer Tax

This site is about the overreaching political power of the NC Association of Realtors flush with money from cashing in your equity 6% at a time, leaving you to pay for growth with property taxes, year after year, with or without cash flow. In the last few years NCAR has pumped millions of dollars into NC political campaigns at the state and local level. They have spent millions more to defeat Local Options for Local Governments with misleading ads.

It's not rocket science

Support Your County Transfer Tax

Posted by

gregflynn

0

comments

![]()

![]()

At the rate of spending revealed so far it appears that the NC Association of Realtors (NCAR) and the NC Home Builders Association have committed to spend at least $400,000 each in fake grassroots efforts to defeat the transfer tax in the 16 counties holding a referendum on the issue. Contributions from affiliated realtor groups could bring the total projected state budget close to $1,000,000 for local astroturf committees alone. This in addition to state level lobbying expenditures by NCAR of $938,787.

Johnston County Astroturf Report

According to documents filed 10/26/07 with the Johnston County Board of Elections for the Johnston County Property Owners Against Transfer Taxes, Donald Byrd, a director of the Johnston County Association of Realtors, is treasurer and funding in the amount of $74,386 comes from the NC Association of Realtors, Triangle MLS and, the NC Home Builders Association. Of this $69,532 has been spent with $4,854 cash on hand. $25,000 Triangle MLS

$25,000 Triangle MLS

$28,500 NC Home Builders Association

$14,500 NC Association of Realtors

$999 NC Association of Realtors in-kind

$5,387 Other sources (previous in-kind)

$74,386 Total

Harnett County Astroturf Report

According to documents filed 10/26/07 with the Harnett County Board of Elections for the Harnett County Citizen Against The Home Tax, Jan Morris, a Realtor in Coats, is treasurer and funding in the amount of $45,425 comes from the NC Association of Realtors, the Fayetteville Association of Realtors and, the NC Home Builders Association. Of this $42,938 has been spent with $2,488 cash on hand.

$1,000 Fayetteville Association of Realtors

$19,655 NC Home Builders Association

$18,700 NC Association of Realtors

$999 NC Association of Realtors in-kind

$5,071 Other sources (previous in-kind)

$45,425 Total

According to documents filed 10/18/07 with the Harnett County Board of Elections, Dallas Woodhouse registered the AFP-Harnett County referendum committee listing a contribution of $2,900 from Americans For Prosperity, Washington, DC.

This follows similar reports from Henderson County and from Chatham County:

The Henderson County Coalition to Protect Home Equity committee's funding of $42,233 comes from the NC Home Builders Association ($24,950) and the NC Association of Realtors ($17,283)

According to documents filed 10/17/07 with the Chatham County Board of Elections, Dallas Woodhouse registered the AFP-Chatham County referendum committee listing a contribution of $2,900 from Americans For Prosperity, Washington, DC.

Posted by

gregflynn

0

comments

![]()

![]()

It’s Time We Get Serious…about OUR TAXES…and OUR VOTES!

Guest Post by Mike Cross, Chatham County Commissioner:

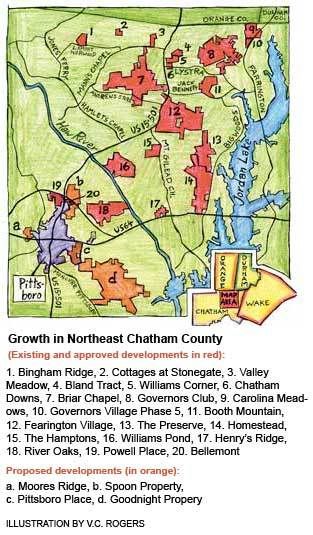

It will soon be time for us to vote “For” or “Against” the 0.4% Land Transfer Tax and I want you to understand what we will be voting for or against, BEFORE you cast your vote! The National Planners Association has identified 10 Mega Regions in the US where massive growth is expected to occur. Of the10 Mega Regions, Chatham County will be part of the Number 1 high growth region (Triangle, Triad into Charlotte-Mecklenburg ). The NCDOT has already designated US64 as a future “Super Connect” between Raleigh and Charlotte. The Association of County Commissioners and the Triangle J-Council of Governments (Orange, Wake, Johnston, Lee, Moore and Chatham) agree that massive growth is coming.

Wake, Durham, Orange, Johnston, Harnett, Lee and Moore are growing “gang busters”. Maybe there’s something to these projections! Whether this turns out to be true or how long it will take to occur are questions I can’t answer. We certainly do have all indications that growth is coming to Chatham with approximately 15,000 homes approved for construction and more proposals coming every week.. With growth, comes requirements for schools, services, other public facilities and the infrastructure to support these requirements.

Based on a .4 students average per household, we may be looking at up to 6 thousand new students over the next 10-12 years. That equates to 6 to 8 new schools; approximately 1 new school every 2 years, plus an average of $1Million in operating cost, per year, per school!

Many have been very outspoken about growth “pays for itself”. Well, it doesn’t pay upfront and it certainly doesn’t appear to have paid it’s way in Wake, Raleigh or Cary, at all – roof tops, commercial, retail, hi and low tech industry - what else does it take to make it “pay for itself”? Last November,’06, Wake County voters approved $1.056 BILLION for Capital Improvements with $970 MILLION going to school construction. This month, October, they approved $276 MILLION in additional Bonds. All this debt will go on their property taxes…increases! Is this the example of how “growth pays for itself”? This is Halloween “Scary” to me!

With an average cost of $375,000 on new homes, these new homes are obviously not being built for current Chatham residents. Our new citizens are going to expect their schools and services to be in place when they arrive. Waiting until their first property tax payments come in to start planning and construction, simply isn’t going to work. Maybe a little up-front revenue generated by our newcomers would be appropriate.

No one wants higher Property Taxes or higher School Impact Fees! In fact, I don’t know anyone who wants higher taxes, period and no tax appears completely fair to everyone. But the requirements of growth have to be paid for and here is the opportunity for us to decide just how we prefer to pay for at least some of it.

There will have to be significant tax increases in our future, so we are really voting on which tax we prefer to start with. Our BOC is requesting your support with the 0.4% Land Transfer Tax , because we believe this is the most fair option. It’s based on sales price, whereas SIF is a flat fee regardless of sales price or square footage. Seems more fair to me. Without the LTT, we will have to, once again , go to Property Taxes, School Impact Fees and/or take another look at imposing Adequate Public Facility Fees.

The 0.4% LTT is not a “Do All/Fix All” tax, but it would allow us another option to pay Debt Service on at least one new school. It takes $1 Million/year for debt service for every $10 Million borrowed and schools are very expensive: Elementary,$18-$22 Million - Middle, $24-$28 Million – High School $38-$43 Million!

The 0.4% LTT would be negotiated in the transfer/sale/purchase of property. It does not apply to wills or gifts and it does not arrive in the mail every year. For most of us, that means we don’t need to be concerned, unless we decide to sell or buy. It’s a relatively small tax, only1/15th as much as the normal Realtor’s Fee.

You have no doubt read or heard some of the following quotes from those who oppose LTT:

“Who’s paying for the Anti- LTT effort?” The North Carolina Realtors Association is the primary contributor. They have blocked all LTT efforts since 1990 – millions in political contributions, TV/Radio ads, Mailers, Telephone Call Banks, Emails and Paid Lobbyist to put the heat on us and our Legislators. Why do they do this? 6 NC Counties and 38 of our 50 States have LTT. It has proven to be beneficial to this industry and the citizen communities where it is applied. Schools, Services, Public Facilities and Infrastructure help to “SELL” their products! Thankfully, many of our Chatham Developers, Builders and Realtor realize these benefits and actually support our LTT Referendum.

“Politicians Should Listen to the Voters”. I certainly agree!…and apparently, so do the majority of our NC Legislators. Perhaps now would be a good time for Voters to listen to their elected officials; the citizens to whom they have bestowed their “Public Trust”.

I have now served on 2, very different, Boards of Commissioners and 8 consecutive County Commissioners have agreed on our Capital Improvements Plan and all agreed to seek LTT to help pay the bills.

Most of us are really tired of higher property taxes. Many simply cannot afford more. For some, it’s already a matter of food, medicine or heat for the winter. And remember, if I vote to raise Your property taxes, I would also be voting to raise My property taxes and I really don’t care to do that! LTT would soften that action.

Property values in Chatham have increased tremendously and large profits are being enjoyed. Those who are profiting – Investors, Developers, Builders, Mortgage Bankers, Attorneys, Sellers and Realtors shouldn’t expect the current/average Chatham citizen to foot all of the bills for the new schools, services, facilities and infrastructure required to support and sell their future products.

Without massive and rapid growth, we probably don’t need anything! But since it is quite apparent that this influx of growth is coming, whether you or I like it or not, help your BOC pay the bills.

Please VOTE “FOR” the 0.4% Land Transfer Tax.

I thank you for your support,

Mike

Posted by

gregflynn

2

comments

![]()

![]()

The North Carolina real estate industry has a little secret that may get a little sunshine, or not. According to the Carrboro Citizen 10/11/07 real estate brokers are not required to notify buyers in writing about bonuses paid to the broker by a seller in addition to sales commission.

The North Carolina real estate industry has a little secret that may get a little sunshine, or not. According to the Carrboro Citizen 10/11/07 real estate brokers are not required to notify buyers in writing about bonuses paid to the broker by a seller in addition to sales commission.

The North Carolina Real Estate Commission voted last week to convene a task force to determine whether homebuyers in North Carolina are being made sufficiently aware when the real estate agent showing them a home is being offered a bonus by the seller. As the regulations now stand, agents must tell buyers of such financial incentives but are not required to notify them in writing. Many sellers, particularly homebuilders, pay a bonus to agents in addition to the sales commission.However the task force will be comprised of "representatives from throughout the industry" so don't hold your breath for full disclosure. An earlier Charlotte Observer story (via N&O 10/11/07) notes that:

The panel was responding to an Observer investigation of Realty Place, which received millions of dollars in bonuses from home builders in exchange for finding buyers for their homes.The original Charlotte Observer Investigation 9/30/2007 shows:

:::::

In more than 50 interviews with Realty Place customers, the Observer found no one who was aware of the bonuses.

Realty Place worked closely with the builders it had vowed to beat up. The company funneled buyers into low-priced starter-home developments, many of which are now plagued by foreclosures.What kind of bonuses are we talking about in the Charlotte area? The sidebar of the Charlotte Observer Investigation goes into detail on real estate bonuses and practices in Charlotte which "are offered on about 40 percent of newly built homes and about one-fourth of existing homes". The following slideshow of images from the current Charlotte realtors' publication will give you an idea of some broker incentives beyond standard commission splits:Realty Place's marketing, sometimes subsidized by builders, regularly and dramatically understated the cost of buying a home.

Posted by

gregflynn

0

comments

![]()

![]()

We told you about the multitude of realtor funded fake grassroots groups in Astroturf Rising. Now BlueRidgeNow.com has an article about the Henderson County Astroturf Coalition funded by NC Realtors and NC Home Builders.

We told you about the multitude of realtor funded fake grassroots groups in Astroturf Rising. Now BlueRidgeNow.com has an article about the Henderson County Astroturf Coalition funded by NC Realtors and NC Home Builders.

Anti-tax mailings spur questions

Judd Richardson, Hendersonville Board of Realtors president, said the Henderson County Coalition to Protect Home Equity includes Hendersonville Board of Realtors, Hendersonville Home Builders Association, North Carolina Home Builders Association, North Carolina Association of Realtors and citizens.Local leaders aren't buying the hype.

:::::The treasurer is Paul Taylor, president of the Hendersonville Home Builders Association. The group received a check for $24,950 from the North Carolina Home Builders Association and a $17,283 in-kind contribution from the North Carolina Association of Realtors.

The group had $24,950 cash on hand and had expended $17,283 of in-kind contributions, the report says.

County Commission Chairman Bill Moyer said he also has seen the mailings.

"It is disappointing they would do this," Moyer said. "They think they are protecting their own self-interest."

Moyer said it is misleading that the coalition would try to present itself as a grassroots organization when outside money is funding the campaign.

"I think they are making it appear like it is a broad-based citizens group," he said, adding, "This is not a local effort to oppose it."

Posted by

gregflynn

0

comments

![]()

![]()

From a Winston-Salem Journal article:

Connie Kowalske, a real-estate agent for Howard Realty and the treasurer of the Davie County Coalition Against a New Home Tax. “We’re the only (sic) organized group that can speak for homeowners. As Realtors, we have pledged to protect private property rights.”

But not all real-estate agents are against the tax. Neal Foster, the owner of the real-estate firm Neal Foster & Associates Inc., said that Davie doesn’t have enough commercial growth to support the needs of the community. He is also a member of the group Davie Alliance, which formed this year to work on local issues.

“The land-transfer tax and the sales-tax are an alternative to take the burden off the landowners and property owners,” he said.

Posted by

gregflynn

0

comments

![]()

![]()

When your gas tank hits empty it usually means you have about 8% of your tank capacity left, enough to get you to a gas station allowing for a few diversions. If you kept your tank at "empty" all the time you couldn't get very far without totally running out of fuel and couldn't take care of much business. It would be imprudent. Even cash strapped drivers put an extra $5 or $10 worth of gas in the tank to make sure there's a cushion to get to work, take care of the kids and, run errands.

The John Locke Foundation wants North Carolina counties to run on empty. In a series of cookie-cutter bogus reports the most egregious example of fiscal irresponsibility is the assertion by Roy Cordato that North Carolina counties should cut their fund balance to a dangerous low of 8% and absurdly misquotes the NC Treasurer to support this position. He argues that amounts over 8% are spare dollars that should be spent or given away.

The State Treasurer’s policy manual states that county undesignated-fund balances should not drop below 8 percent of total expenditures.The Treasurer does not recommend reducing cash reserves to the 8% danger level. This assertion is based on selective reading of the Treasurer's recommendations:

:::::

...above the 8 percent strongly recommended by the Treasurer [is] cash that is currently available to help with existing needs or to provide much needed tax cuts or both.

The majority of property tax revenues are received in the latter months of the calendar year. Therefore, there should be reserves on hand in the form of fund balance available for appropriation at June 30th to prevent the unit from experiencing cash flow difficulties during the first two quarters of the next fiscal year. The minimum level of fund balance available for appropriation that should be on hand to enable the unit to meet current obligations and to prevent the unit from experiencing cash flow difficulties is 8% of the prior year's expenditures.But wait, there's more. The Treasurer recommends additional reserves for unforseen needs or opportunities beyond the "minimum" 8%.

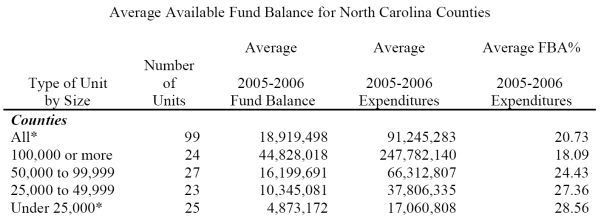

In addition to the 8% needed to prevent cash flow difficulties, units also maintain fund balance available for appropriation in the General Fund in case unforeseen needs or opportunities should arise. Fund balance available for appropriation at June 30th is a source that may be budgeted in the following year to address these situations. There is not an established minimum amount that should be in reserve for these purposes. The officials of the individual units should make that determination. The amount of fund balance available for appropriation maintained by a particular unit would be influenced by such factors as the size of the unit, economic conditions within the unit, future capital outlay needs, stability of revenue sources and susceptibility of the unit to natural disasters.The total recommended reserve is not an absolute number but is one based on the size and unique needs of each county. For the state as a whole that average number is 20.73% and the average ranges from 18.09% - 28.56% depending on the size of the county.

The staff sends letters to units if the amount of fund balance available for appropriation as a percentage of prior year expenditures in the General Fund falls below 8%. The staff also compares the percentage of fund balance available for appropriation to the prior year percentages for similar units. If that percentage is materially below the average of similar units, the staff will send a letter to alert the unit of this fact. Units will be encouraged to evaluate the amounts in reserves and determine if the level is adequate.A county that runs a fund balance of 8% is living on the edge, has limited ability to respond to unforseen events, has seriously impaired bonding capacity and limited ability to make improvements in county infrastructure at the beginning of a fiscal year before revenues have accumulated.

The chart below shows the average percentage of fund balance available for appropriation for similarly grouped counties for the fiscal year ended June 30, 2006. Officials should use these figures to compare their unit to similar units and evaluate the adequacy of their unit's current reserves.

Posted by

gregflynn

0

comments

![]()

![]()

Chatham County has been a political laboratory for developers and realtors in recent years, as documented by Jennifer Strom in The Independent:

Chatham County has been a political laboratory for developers and realtors in recent years, as documented by Jennifer Strom in The Independent:

It started in 2002

How Bunkey Won: A Chatham County group tapped into Triangle-wide developers' coalition

Fast forward to 2006:

High noon in Chatham: County on edge as the primary election nears

These are legitimate groups:

The Chatham Coalition

Chatham Citizens for Effective Communities

Pittsboro Together

This is the official Chatham County information site:

Chatham Land Transfer Tax Referendum

The name "Chatham County Coalition for Homeownership" is deliberately chosen to sow confusion with the legit "Chatham Coalition". All counties should expect robo-calls and a last minute surge of disinformation, much of it sourced from Civitas and John Locke Foundation.

Rob Schofield had a good review of the disinformation being circulated about this complex issue:

One Size Does Not Fit All

Yesterday Chris Fitzsimon had an article summarizing the realtors involvement:

The Realtors’ misleading rhetoric continues

Having just flown over Chatham County this week it was dismaying to observe the pock-marked landscape with large swaths of cleared red dirt each relieved only by a handful of specks representing the first buildings of subdivisions and all within sight of the dried shores of Lake Jordan.

Posted by

gregflynn

0

comments

![]()

![]()

Faced with a drought of public support for its high profile opposition to the transfer tax the NC Association of Realtors (NCAR) has replaced the withered remains of the "Stop The NC Home Tax" website. With newly installed Astroturf at the same address called "Vote No on the Home Tax" hoping to fool county voters into thinking it is a real grassroots movement the website has scrubbed all references to NCAR. In its place is a roster of newly formed "Local Committees" to provide cover for the real involvement of the realtors' group.

Voters in Chatham County have been scratching their heads over robo-calls from a hereto unknown group called Chatham County Coalition for Homeownership. Meanwhile Brunswick County voters are slowly finding out that the Committee of Concerned Brunswick County Property Owners is an organization of realtors, homebuilders and, mortgage brokers headed by Steve Candler, governmental affairs director for the Brunswick County Association of Realtors.Swain County Property Owners Against the Transfer Tax

Macon County Citizens Against the Transfer Tax

Graham County Citizens Against the Transfer Tax

Rutherford County Property Owners Against the Transfer Tax

Henderson County Coalition to Protect Home Equity

Union County Coalition Against the Home Tax

Davie County Coalition Against a New Home Tax

Chatham County Coalition for Homeownership

Moore County Coalition For Good Government

Hoke County Citizens to Protect Homeownership

Harnett County Citizens Against the Home Tax

Johnston County Property Owners Against Transfer Taxes

Pender County Coalition to Protect the American Dream

Committee of Concerned Brunswick County Property Owners

Washington County Landowners Against the Transfer Tax

Gates County Citizens Against Higher Taxes

Posted by

gregflynn

0

comments

![]()

![]()

The NC Realtors recent lobbying report showed expenditures of $43,740 going to Fallon Research & Communications of Columbus, Ohio, for Voter Opinion Survey services. That company name popped up late September when selective results from a phone survey conducted among Raleigh and Cary voters July 22-24 by Fallon Research & Communications were released. At the time the results were released, Public Policy Polling was not familiar with the organization, though referenced the following article from The Texas Observer, an independent investigative publication. The fast growing town of Frisco, Texas was considering ordinances to control shoddy building practices two years ago.

To drive home this alarming message, the opposition quickly cobbled together an Astroturf political action committee named Citizens United for Frisco’s Future or CUFF.From a 5/27/2004 article, an auto-bio of owner Paul Fallon:

:::::

CUFF has also spent $3,500 with Ohio-based Fallon Research and Communications, a Republican polling firm with ties to the housing industry, and $13,000 with Cornerstone RSCS for the production of the aforementioned TV ad. Both these companies have been hired by builder-financed PACs in recent years to help defeat citizen initiatives around the country.

Paul Fallon is a public opinion researcher, political pollster and advisor for corporations, trade groups, levy committees, interest groups, political candidates and public organizations. He has worked on numerous projects, campaigns and ballot issues throughout the country. He also conducts customer, member, contributor and citizen satisfaction studies for government agencies, industry and labor groups, public agencies and private companies. He recently completed a 3-year stint as the director of public opinion research for the National Association of Home Builders. Paul was responsible for opinion research, as well as political polling for a highly successful ballot issue management program that resulted in numerous successes in campaigns at the state, county and local level. During that time he earned a reputation for helping candidates navigate complex growth issues affecting their campaigns. He previously served as director of public opinion research for the Ohio Republican Party.The Frisco measures were subsequently defeated:

Perhaps it’s because the homebuilding industry, the state’s leading real estate association, the local chamber of commerce, and the city government teamed up to spend at least $100,000 in a smear campaign. Efforts to defeat the proposals and vilify their main champions, the Becka family, included television and newspaper ads, signage posted all over the city, and borderline propaganda on the city’s website. “The vote demonstrates how easy it is to sway an election if you have enough money,” wrote Dr. David Becka

Posted by

gregflynn

0

comments

![]()

![]()

$938,787.07 - is the latest total for spending by the NC Association of Realtors trying to defeat local revenue options for local governments. In a lobbying report dated 10/11/07, filed at the Secretary of State's Office, the NC Realtors reported Solicitation of Others spending of $45,800.21 in the month of September, of which $43,740 went to Fallon Research & Communications of Columbus, Ohio, for Voter Opinion Surveys.

Posted by

gregflynn

0

comments

![]()

![]()

Greetings Buncombe County visitors. Thanks to Chasing the Bread Truck I can see that you all are having problems similar to Wake County in terms of realtors influencing local politics. In a recent email circulated to members in Wake County the Raleigh Regional Association of Realtors (RRAR) played its hand and finally endorsed Mary Ann Baldwin and others, as expected, for Raleigh City Council seats.

In September RRAR formally endorsed the following Raleigh City Council candidates widely considered to be development friendly: Tommy Craven, District A, incumbent, Jesse Taliaferro, District B, incumbent and Mary Ann Balwin, candidate for one of two At-Large seats. Also endorsed were unopposed incumbents James West, Phillip Isley and the current Mayor Charles Meeker.

The board also voted to endorse Nels Roseland, John Rigsbee and Tommy Byrd for Cary Town Council and the current Mayor Ernie McAlister. Sean O'Brien and Ron Margiotta were endorsed for Wake County School Board. RRAR also endorsed Rob Bridges and David Camacho for Wake Forest Commissioner, Charlie Adcock for Commissioner in Fuquay Varina, Peter Atwell and Laurie Clowers for Councilors for Town of Holly Springs, Bryan Gossage for Town Council in Apex and Liz Johnson for Commissioner in Morrisville.

Update: A few snippets from the RRAR email:

This election is expected to have a very low voter turnout (11-13%), and REALTORS getting out to vote could make the difference for our candidates.

:::::

"Strong municipal leadership from our elected officials will be a critical part of our future success," said Association President Phyllis York Brookshire.

:::::

We'd like to thank everyone who contributed to RPAC this year. We are still trying to raise those last few thousand dollars to get us to $100,000; to date we have raised $94,000. These funds come back to us to help us support candidates in Wake County

Posted by

gregflynn

1 comments

![]()

![]()

According to the Tryon Daily Bulletin Polk County Commissioner have postponed their Transfer Tax referendum from November to May 2008. Commissioners have been split on how to spend the estimated $1 million in revenue if enacted and voter turn-out would be low relative to the May primary.

Elswhere, despite misleading headlines, a poll shows support for Transfer Tax when used for schools. Also, despite their best attempts at spin, a Triangle Community Coalition poll shows solid public support for controls on growth.

Update:

Heather reminds us above that antonymously named realtor/builder organizations are not restricted to the Triangle. The Mountain Council for Accountable Development is actually a group of realtors and Asheville homebuilders.

Polk County is considering an 80/20 split of Transfer Tax revenues with 20% to be used for matching grant programs to purchase open space to protect water sources and preserve Polk's rural allure.

Posted by

gregflynn

0

comments

![]()

![]()