Running On Empty

When your gas tank hits empty it usually means you have about 8% of your tank capacity left, enough to get you to a gas station allowing for a few diversions. If you kept your tank at "empty" all the time you couldn't get very far without totally running out of fuel and couldn't take care of much business. It would be imprudent. Even cash strapped drivers put an extra $5 or $10 worth of gas in the tank to make sure there's a cushion to get to work, take care of the kids and, run errands.

The John Locke Foundation wants North Carolina counties to run on empty. In a series of cookie-cutter bogus reports the most egregious example of fiscal irresponsibility is the assertion by Roy Cordato that North Carolina counties should cut their fund balance to a dangerous low of 8% and absurdly misquotes the NC Treasurer to support this position. He argues that amounts over 8% are spare dollars that should be spent or given away.

The State Treasurer’s policy manual states that county undesignated-fund balances should not drop below 8 percent of total expenditures.The Treasurer does not recommend reducing cash reserves to the 8% danger level. This assertion is based on selective reading of the Treasurer's recommendations:

:::::

...above the 8 percent strongly recommended by the Treasurer [is] cash that is currently available to help with existing needs or to provide much needed tax cuts or both.

The majority of property tax revenues are received in the latter months of the calendar year. Therefore, there should be reserves on hand in the form of fund balance available for appropriation at June 30th to prevent the unit from experiencing cash flow difficulties during the first two quarters of the next fiscal year. The minimum level of fund balance available for appropriation that should be on hand to enable the unit to meet current obligations and to prevent the unit from experiencing cash flow difficulties is 8% of the prior year's expenditures.But wait, there's more. The Treasurer recommends additional reserves for unforseen needs or opportunities beyond the "minimum" 8%.

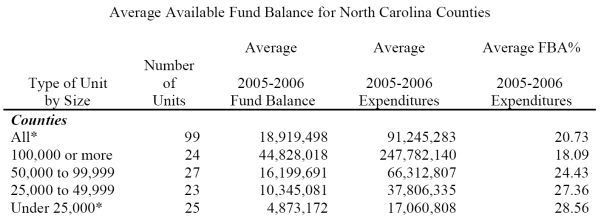

In addition to the 8% needed to prevent cash flow difficulties, units also maintain fund balance available for appropriation in the General Fund in case unforeseen needs or opportunities should arise. Fund balance available for appropriation at June 30th is a source that may be budgeted in the following year to address these situations. There is not an established minimum amount that should be in reserve for these purposes. The officials of the individual units should make that determination. The amount of fund balance available for appropriation maintained by a particular unit would be influenced by such factors as the size of the unit, economic conditions within the unit, future capital outlay needs, stability of revenue sources and susceptibility of the unit to natural disasters.The total recommended reserve is not an absolute number but is one based on the size and unique needs of each county. For the state as a whole that average number is 20.73% and the average ranges from 18.09% - 28.56% depending on the size of the county.

The staff sends letters to units if the amount of fund balance available for appropriation as a percentage of prior year expenditures in the General Fund falls below 8%. The staff also compares the percentage of fund balance available for appropriation to the prior year percentages for similar units. If that percentage is materially below the average of similar units, the staff will send a letter to alert the unit of this fact. Units will be encouraged to evaluate the amounts in reserves and determine if the level is adequate.A county that runs a fund balance of 8% is living on the edge, has limited ability to respond to unforseen events, has seriously impaired bonding capacity and limited ability to make improvements in county infrastructure at the beginning of a fiscal year before revenues have accumulated.

The chart below shows the average percentage of fund balance available for appropriation for similarly grouped counties for the fiscal year ended June 30, 2006. Officials should use these figures to compare their unit to similar units and evaluate the adequacy of their unit's current reserves.

The misrepresentation by the John Locke Foundation of what the Treasurer recommends as fiscally prudent is inexcusable. They will say anything for political gain. This "talking point" has been in the works for several months. The Realtors Association and representatives have been using it to claim that counties are flush with cash. The JLF's Donna Martinez dropped it on Chatham County Commissioner Mike Cross on a TV show a while back (to little effect).

No comments:

Post a Comment